Introduction

-

Define Objectives

-

Complete Valuation

-

Does Valuation Meet

-

If No, Revamp

-

If Yes, Decide Exit

-

Using Direct Sale

-

Navigate

![]() introduction

introduction

Business Exit Illustration

Why Develop An Exit Plan

Every business owner will need to exit whether it is soon or sometime in the future. The goal is to exit at the most advantage time when you achieve the greatest financial and transitional benefit.

Page Topics:

![]() business exit model

business exit model

Exit Plan: Segment A

Estate Planning Objectives

The first segment in the exit plan defines the business owner's financial and estate planning objectives. This involves a review of the owner's plan to determine what objectives need to be established if an exit is required:

The Process Flow

- Start the exit planning process

- Review with owner their estate planning and financial goals

- Determine if they have a plan. If not, then refer them to their CPA and/or our advisory network of estate planners.

| Krayton M Davis Executive Director, CFOne Business Advisory Services Serving Richmond and Northern VA 1-571-306-3590 or e-mail your inquiry to: |

Why Do Owners Exit

Our experience over the past 15 years note the following reasons why owners exit.

- Ready to Retire

This is a noble reason to exit. But it turns out to be an error for many owners. We often find that many retirees are looking to exit without any financial objective.

We recommend that owners plan their "retirement" exit with an long-term financial objective and age limit working together to maximize the benefit. - Burn-Out Factor

We experience those who exit simply do so due to burn out. They often are looking to explore "other opportunities".

This is a dangerous exit position to be in. Owners generally don't have the energy to maximize the the exit value. The financials begin to slip that devalue the company. - Health Reasons

This is an unfortunate position to be and often unexpected and unavoidable. Depending on the health position, the owner may need to exit promptly and health reasons generally impact the company value. - Need to Focus On a 2nd or 3rd Operation

Some business owners operate more than one business and will off-load one of the businesses that may not be performing. These owners are looking to get whatever value the market will bear.

Having an exit plan in place would have likely put them in a better position when offloading.

There are other reasons why owners exit. But these four reasons make-up about 90%+ of all exits.

So the first question in the exit plan is what are the benefits that the owner could realistically achieve. The goal is to come up with a realistic financial number that will meet your financial and estate planning objectives.

![]() business exit model

business exit model

Exit Plan: Segment B

Assemble and Complete a Company Valuation

Once you have set your financial objective, the next step is to complete a valuation on your business to see if your current operating numbers will meet your financial goals.

The Process Flow

1: Exit planning review:

- discuss goals and objectives of the valuation

- review tax implications

2: Complete the business valuation report:

- collect data

- select value parameters

Types of Valuations

An Value Assessment Report

Provides an approximate indication of value based upon the performance of limited procedures agreed upon by the appraiser and the client. The results can be expressed as a single dollar amount or as a range.

The valuer will only consider limited relevant information and will perform only a limited analysis. This type of report is generally used by smaller companies.

This type of report is complimentary at no cost or obligation. It is a good starting point when designing your business exit strategy.

A Limited Scope or Market Valuation Report

Provides a fair market value opinion. It is a more extensive analysis: Asset, income and Market Approaches are considered. Market methods are based on generic group multipliers. Discounted Future Cash Flows and Discounted Future Earnings methods may be available; sometimes historical methods only. Public company comparisons are non-existent, or at best, very limited.

A limited review of business risk factors is performed and the competitive environment is examined, and there is an abbreviated company description. This is the most common report to support a business sale and the results are often used to support the pre-approval of a business for Commercial financing, thus limiting your need to hold a Seller's Note!

A Comprehensive or Self Contained Report

Provides an extensive analysis. All valuation methods are applied as applicable. Comparable sales transactions and multipliers for the Market methods are very specific to the Company's business. Public company comparisons are available and used when needed.

A comprehensive review of the business risk factors is undertaken, a detailed description of the company and its positioning is provided, and a review and assessment of the prevailing economic conditions in the specific industry is undertaken.

A member of our team will discuss the type of valuation need based on our financial goals and tax implication. Let's discuss:

![]() business exit model

business exit model

Exit Plan: Segment C

does the valuation meet the financial objectives

We now come to a key question - does the valuation meet your financial objective? If yes, we can move to the exit stages. If no, we will complete a complimentary review of your business fundamentals.

The Process Flow

- Compare the valuation with the financial goal

- If it meets the goal, move to the exit stages of the exit plan: Segment E

- If no, complete a complimentary review of the business fundamentals: Segment D

The Business Fundamentals

The business fundamentals comprise the review of four key business parameters:

- marketing and e-commerce strategy

- financial analysis

- business operation

- HR and other

The review of the business fundamentals will be discussed on Segment D

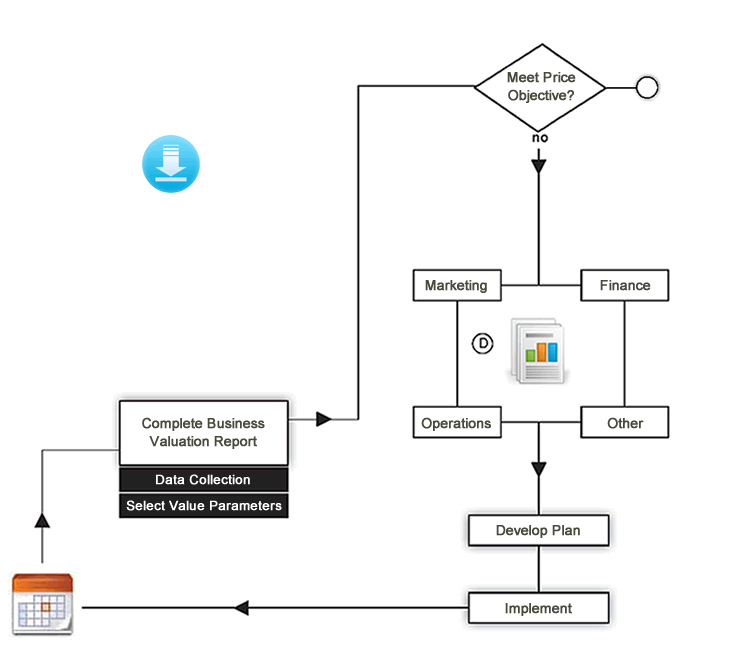

![]() business exit model

business exit model

Exit Plan: Segment D

if no - revamp and develop the business fundamentals

Some of the valuations may conclude that the valuation number fails to meet the financial goals of the owner. It then becomes apparent to either move forward or make some strategic changes to increase the valuation over time.

The Process Flow

- Review each of the business fundamentals and recommend possible changes (complimentary review)

- Develop a plan of execution upon owner review and approval

- Execute and implement the plan

- After a defined set of time, complete another valuation to determine next steps

Revamp Operations

Marketing Review

We will complete an analysis of your current market and industry. This includes a SWOT analysis, macroeconomic review, PMI analysis, segmentation analysis, and life-cycle strategy review.

The goal is the recommend the following market strategies:

- Product Enhancement - Development

- Pricing Changes and Discounts

- Placement and New Distribution

- Promotional Options

see out tools: marketing prep module

Financial Statements

Two areas we look at. One, are the financial statements properly accounted for. Too often financial statements don't reflect the true cash-assessment of the company. Many owners add non-operational expenses that devalue the company.

We will review the reporting structure and recommend changes that will reflect the true cash assessment.

See tools: financial prep module

Another recommended implementation is to build the credit standing position of the company.

Operations

One of the key operational change that we recommend is to migrate the business owner from the day-to-day operations of the company.

Much too often, the owner is the key operating person of the company — thus becoming the goodwill of the company. The goal is to shift the operations over to another trusted individual so that the owner can focus on key strategic decisioning.

This tactical move can add value to the company because prospective buyers are looking at operations that are not owner-driven numbers. This allows the buyer to take over the operation without repercussions of lost relationships that are tied to the owner.

Other

Other analysis may include staffing operations, e-commerce position, and other operations that are specific to your business.

Implementation

Once the strategy has been written under the direction of the owner, we estimate the required capital and resources needed to implement key phases of the strategy. We can manage the implementation or act as advisors as needed.

As progress is made with successful implementation, we will re-do the valuation based on the new numbers to determine if the valuation meets your financial goal.

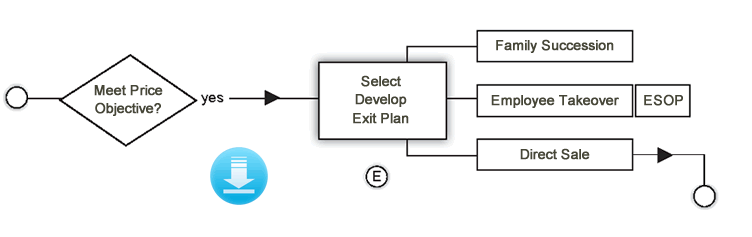

![]() business exit model

business exit model

Exit Plan: Segment E

if yes - decide the type of exit

If the valuation meets the price objective of the owner, we can move to the exit planning stages.

Succession Plans

The type of succession plan usually falls with these three key successions.

Family Succession

This will require a comprehensive valuation under estate planning rules. We cannot provide legal guidance, but we can help in the transfer over to family members under a fee arrangement.

Family succession may include direct family or extending family. Again, this is under legal guidance by one of the recommended advisors.

Employee Take Over

This will likewise require a comprehensive valuation to write-up the true valuation of the company when generating the legal documents.

Employee take-over can be in the form of a direct sale or employee stock ownership plan. Again, this is under legal guidance by one of our recommended advisors.

Direct Sale

The direct sale is the most selected plan among business owners. This is where our expertise comes in. We can facilitate the entire process to ensure the maximum price. Our fee is based only on the successful closing of the sale.

![]() business exit model

business exit model

Exit Plan: Segment F

taking the direct sale as your exit plan

A direct sale involves finding an outside buyer to buy 100% of your company or undertake a merger under a negotiated price.

The Process Flow

- Set the selling price based on the valuation

- Build the confidential memorandum that will be shared with qualified buyers

- Develop the business selling plan

- Screen buyer / negotiate buying offer

- Arrange closing / structure financing

The Selling Process

CFOne Business Advisory has a combined 15 years experience in business selling and acquisition/mergers. We do all of the work necessary to find the right buyer at the right price.

We set the price based on the valuation, build the confidential memo that illustrates the qualitative and quantitative review of the company (this will be shared with qualified buyers), develop the selling plan, screen buyers, negotiate the offer, and finalize the offer and close on the sale. There is zero upfront fees for these services.

See our tools: business selling prep

Conclusion

We have outlined a brief review of the exit planning process. Of course there is much more detail that go into each of these modules.

So give us a call to discuss. Our review is complimentary with zero costs or obligation.

We will walk you through the entire process to address your position and next move.

![]() navigate

navigate

| Navigate Business Broker | |

| business exit planning | |

| Supporting Files | |

| business exit illustration | |

| business exit FAQs | |

| Site Files | |

| home | |

| business exit planning | |

| business broker services | |

| business advisory services | |

| business valuations | |

| tools | |

end of topic

Go To Topic: What's It Worth

Go To Topic: What's It Worth